Which of the Following Is an Employee-contribution Retirement Plan

Money purchase plans401a plans. Employers and employees can contribute up to a total of 25 of an employees net compensation or 61000 whichever is less.

Brochure Retirement Plans Side 2 Retirement Planning How To Plan Retirement

DC plans can be contrasted with.

. Your contributions to the plan are tax-free. The employee also may contribute to this account usually through a pretax wage. Non-Bargaining Unit Employees and TenuredTenure Track Faculty Eligibility and Contributions.

Full-time nonbargaining unit employees and tenuredtenure track faculty may enroll in the defined contribution retirement plan within 31 days of date of hire or during the open enrollment period every June and December. I II and IV only D. There are four types of contributions that employees can make to retirement plans.

All of the above. 401k and 403b are two popular defined-contribution plans commonly used by companies and organizations to encourage their employees to save for retirement. Joslin will contribute for each Plan Year an amount equal to five percent 5 of the Eligible Employees Compensation while an Eligible Employee up to the Social Security Taxable Wage Base plus ten percent 10 of the Eligible Employees Compensation.

The combined amount contributed by employer and employee is 58000 for 2021 61000 for 2022. 1 Elective Deferral Contributions. Form W-2 reporting for retirement plan contributions.

All of the following are CODA plans EXCEPT. 401 k 403 b and tax-sheltered annuities. In addition the employer can match a portion of the contribution made by the employee.

Done correctly transfers and rollovers involve no income tax or penalty taxes. Also called salary reduction contributions these are the most common types of contributions to retirement plans. Box 3 5 Social Security and Medicare wages - Include all employee pre-tax after-tax and designated Roth contributions.

I II and III only C. A 403 b plan a 457 b plan or an IRA those funds will be credited to the other contribution or rollover account component of your individual account. Answer Expert Verifiedquestionquestion mark.

These plans are then invested on the employees behalf. Explore different ways to invest your retirement savings. The contributions are generally pretax dollars that are transferred to a retirement account such as a 401 k Plan or 403 b Retirement Plan.

The correct answer is. A money-purchase pension plan is a type of defined contribution plan. Upon retirement the employee receive the balance in their account which is based on contributions plus or minus investment gains or losses.

A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Which of the following is true of defined contribution plans. Participants fund their defined-contribution plans with either a specified dollar amount or a percentage based on earnings.

The correct answer is 401 k. 13 minutes ago401 K Retirement Plan. Its a cash or deferred arrangement thats a defined contribution plan.

Which of the following are payroll costs for employers. A 401k plan is a defined contribution plan established by the employer but which is funded by employee contributions that are a reduction of that employees taxable income. The correct answer is.

Cash or deferred arrangement CODA plans include. An employer may contribute to an employees traditional 401 k account but the employer may not contribute to an employees Roth 401 k account. I and II only.

In a money purchase plan employees specify a level of monthly. Under this plan the employee and their employer both contribute to the employees account. At the broadest level employers can offer a defined contribution plan or a defined benefit plan.

Be sure to consult. To encourage employees to put more of their paycheck into the employee. A defined-contribution plan is an employer-sponsored retirement plan in which the employee and sometimes employer contribute to the employees retirement account.

Select all that apply Check All That Apply Employee contribution to retirement plan Employer contribution to retirement plan Employee portion of FICA taxes oooooo Employer portion of FICA taxes Federal and state income taxes Federal and state unemployment taxes. Fuller Theological Seminary Retirement Plan Employee Contribution - GSRA Learn how to start investing and find out which options are available for this plan. Your contributions to the plan are tax-deferred.

Which of the following are potential benefits of a 401k or 403b plan. Box 1 Wages Dont include pre-tax contributions made under a salary reduction agreement. If you are age 50 or older you can make catch-up contributions of an additional 6500 per year.

You can contribute to your retirement account through your employer andor on your own. In a defined contribution plan the employer contributes a set amount of money each month to the employees retirement account. You can save for retirement.

Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the. Understanding workplace retirement plans. Try a one-step solution.

This plan allows employees to make contributions to the maximum allowable in addition to those made by Joslin Diabetes Center. You can make yourself low-interest loans. Employee contribution plans are usually funded by contributions that are automatically deducted automatically from an employees paycheck.

401 k plans offer employees the option. Two popular types of these plans are 401k and 403b plans. Employee contributions to traditional 401 k accounts are deductible by the employee but employee contributions to Roth 401 k accounts are not.

I II III and IV B. Multiple Choice At retirement age an employee is entitled to contributions plus the investment returns The investment responsibility belongs to the employer Employees avoid using profit-sharing plans as retirement vehicles.

Epf Contribution Of Employee And Employer Employment Contribution Pension Fund

10 Benefits That Will Help Your Company Retain Its Best Employees Topteny Com In 2021 401k How To Plan Retirement Planning

5 Critical Pieces To Answer When Can I Retire When Can I Retire Retirement Savings Plan Financial Checklist

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

How A Safe Harbor Contribution Provision Enhances A 401 K Plan Trpc How To Plan Safe Harbor Retirement Planning

The Best Time To Tap Into Your Government Pensions Retirement Advice Retirement Planning Finance Pensions

Best Retirement And Pension Plans In The Cayman Islands Retirement Fund Pensions Pension Plan

How Does 401k Matching Work Free Money 401k Retirement

What Is An Esop Employee Stock Ownership Plan How To Plan Things To Sell

How Does A Teacher Pension Work Estimate Your Benefit Educator Fi Pensions Investment Advice Financial Independence

This Scheme Provides A Platform To The Corporate To Co Contribute For The Employees S Pension Here The Corporat Pensions Fund Management Saving For Retirement

New Pension Scheme Pensions Life Annuity Annuity

What Is A Retirement Plan Retirement Planning How To Plan Investment Advice

Roth Ira Vs Roth 401 K Simplefinancialfreedom Com Finance Investing Investing Money Money Saving Plan

How To Plan Retirement Planning Math Class

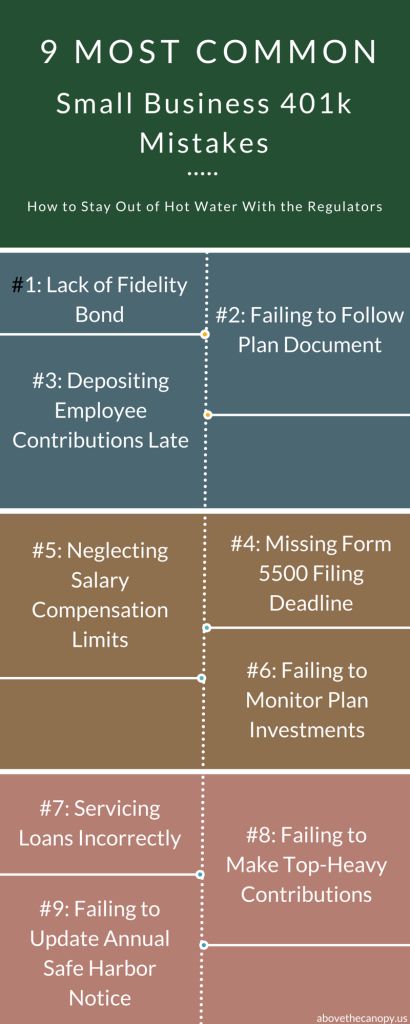

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources Small Business

The Maximum Annual Contribution An Employee Can Make Through Salary Reduction To A 401 K Plan Will Rise To Business Insurance How To Plan Retirement Planning

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workp Profit Shares Contribution Retirement Benefits

Great Infographic Explaining All About Ira Contributions Money Savvy Educational Infographic Smart Money

Comments

Post a Comment